6 mins read

Published Oct 15, 2025

Australia's Funding for Low-Carbon Fuels and What it Means for the Australian Biofuels Sector

Australia is reshaping its energy and industrial sectors to meet its 2030 emissions target (43% below 2005 levels) and net zero by 2050.

Renewable and low-carbon fuels – hydrogen, ammonia, biofuels, and biogas – are central to this effort, targeting emissions from transport, mining, and heavy industry while creating new export markets

Under the Powering Australia agenda and the broader Future Made in Australia Plan, government policy aims to turn clean-fuel production into a major domestic and export industry. Funding mechanisms now span grants, concessional finance, pilot programs, and certification frameworks, though many are still in development.

Federal funding overview

1. Key Federal Programs and Funds

Program / Agency | Description | Funding (approx.) | Status / Notes |

Hydrogen Headstart (ARENA) | Revenue support to close the cost gap for large-scale renewable hydrogen production. | $4 billion (two rounds: up to $2 b in 2023 + up to $2 b in 2024-25) | Confirmed program administered by ARENA. Round 2 launched 2025. |

Sustainable Aviation Fuel (SAF) Funding Initiative (ARENA) | Supports early SAF feasibility and production projects. | Up to $30 million (≈ $14.1 m awarded to early projects. E.g. Ampol, GrainCorp, etc.) | Active; early stage, focused on feasibility and pilot scale. |

Clean Energy Finance Corporation (CEFC) | Concessional loans and equity for clean-energy projects, including hydrogen, bioenergy, and waste-to-energy. | $300 m Advancing Hydrogen Fund + broader clean-energy portfolio | Ongoing commercial finance, not direct grants. |

Powering the Regions Fund (PRF) | Supports trade-exposed and regional industries to decarbonise and build clean-energy capacity. | $1.9 billion total | Confirmed fund under DCCEEW. |

2. Powering the Regions Fund – Main Streams

Stream | Purpose | Funding | Administered by | Status |

Safeguard Transformation Stream (STS) | Grants for Safeguard Mechanism facilities to reduce emissions. | DCCEEW | Active, matched-funding model. | |

Industrial Transformation Stream (ITS) | Regional industrial decarbonisation (e.g. low-carbon metals, clean transport fuels). | ARENA | Round 2 (2025): $70 m available; Round 1: $150 m. | |

Critical Inputs to Clean Energy Industries (CICEI) | Decarbonisation for process industries (cement, lime, alumina, aluminium). | ≈ $400 m (federal + state) | DCCEEW | Funding modelled for 2025-27. |

3. Other Federal Mechanisms

Instrument | Description | Status / Notes |

Certifies origin and emissions intensity of hydrogen, ammonia, and other low-carbon products. | Pilot stage; expansion to low-carbon liquid fuels under design. | |

Cleaner Fuels Program | Proposed $1.1 b initiative for low-carbon liquid-fuel production and supply chains. | Announced 2025; consultation under Future Made in Australia Plan. |

Tax Incentives | Target hydrogen and critical minerals; no legislated $2/kg hydrogen credit as of 2025. | Support via Hydrogen Headstart and CEFC finance. |

Emissions Reduction Fund / ACCUs | Allows eligible bioenergy or waste-to-energy projects to earn carbon credits. | Active; multiple approved methodologies. |

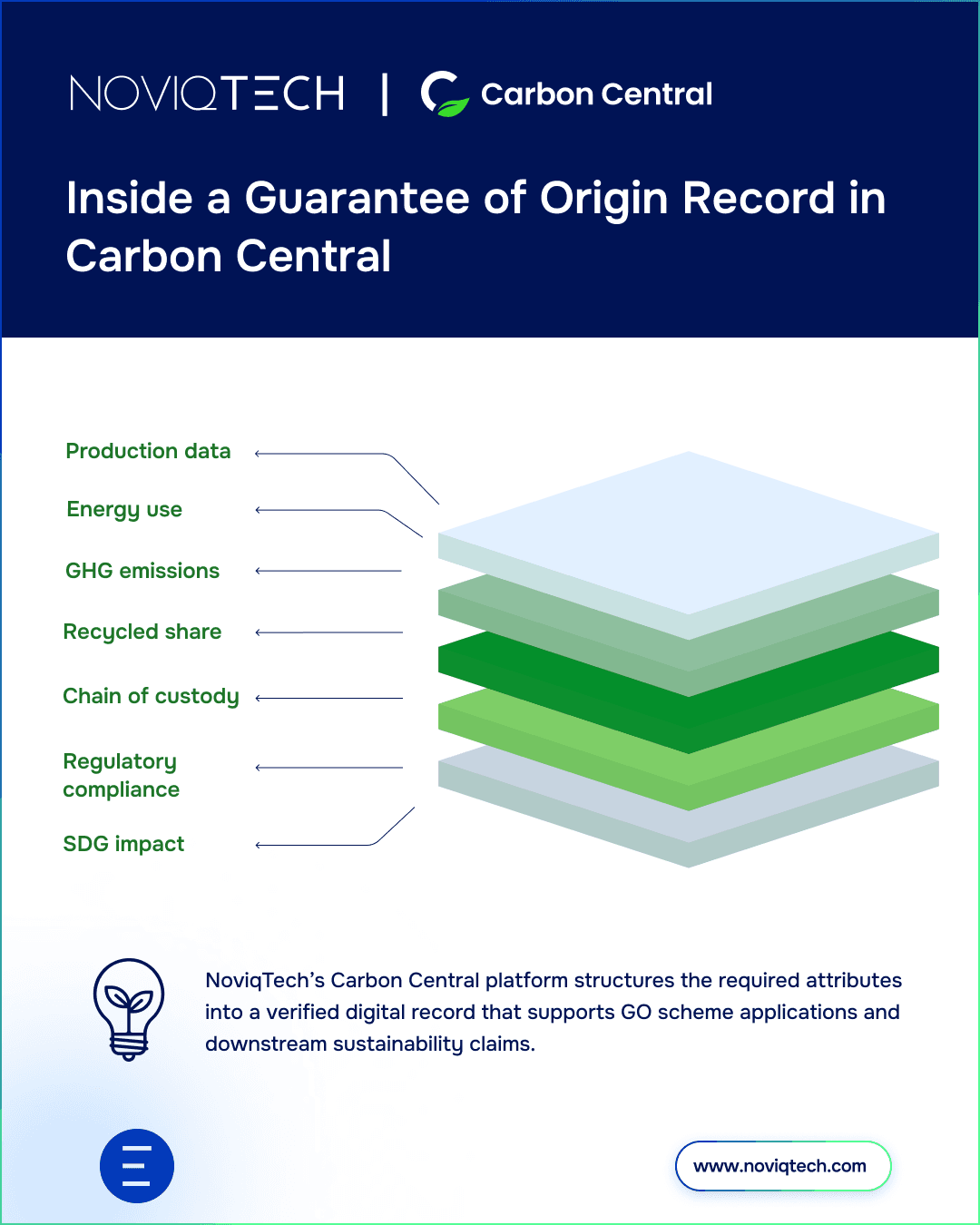

Figure 1: Inside a Guarantee of Origin Record in Noviqtech's Carbon Central platform.

State programs Snapshot

Queensland

Program | Focus | Funding / Details |

Bioenergy Fund | Projects that convert underutilised biomass and waste into bioenergy or bioproducts | $4 m total; 50% matched grants up to $2 m. |

Waste-to-Biofutures Fund | Pilot and demonstration projects for organic or agri-waste-to-fuels. | $5 m total; grants from $50 k – $1 m. |

Sovereign Industry Fund | Builds local capacity in strategic sectors including renewable fuels. | $180 m multi-sector fund. |

SAF Development | Feasibility work and MoUs with Qantas & Ampol for SAF / renewable diesel projects. | Early stage; positions QLD as a future SAF hub. |

New South Wales

Program | Focus | Funding / Notes |

Net Zero Manufacturing Initiative | Grants for low-carbon product manufacturing and clean-tech innovation. | $275 m across three streams; 50% co-investment required. |

Hydrogen Hubs (Hunter & Illawarra) | Shared infrastructure for hydrogen projects aligned with national strategy. | State + ARENA funding. |

Victoria

Program | Focus | Funding / Notes |

Hycel Hydrogen Hub (Deakin University) | Hydrogen R&D, training, and testing centre. | ≈ $18 m (Commonwealth + State). |

Guides integration of renewable H₂ and biomethane into gas networks. | Strategic plan (not a grant program). | |

Hydrogen Pilots | Includes 10 MW electrolyser at Wodonga and hub support at Swinburne University. | Pilot stage. |

Western Australia

Program | Focus | Funding / Notes |

Pilbara Hydrogen Hub | Shared infrastructure for hydrogen and ammonia production. | $140 m (50:50 Commonwealth + WA). |

Clean Energy Future Fund | Competitive grants for low-carbon projects. | $37 m total; >$16 m allocated across 7 projects as of 2025. |

South Australia

Traceability, Certification, and Mandates

Australia is building a national system to verify the sustainability and emissions intensity of low-carbon fuels.

Guarantee of Origin (GO): being expanded to include liquid fuels; will enable verified carbon accounting and export credibility.

Certification systems: alignment with ISCC EU and RSB standards is under review to support global market access.

Mandates: no national blending or usage mandates for SAF, renewable diesel, or hydrogen fuels as of late 2025. Demand-side mechanisms remain under federal consultation.

Digital tracking tools: traceability platforms (e.g. Carbon Central) can support compliance.

How Businesses Can Leverage These Incentives

Strategy | Practical Steps |

Pursue Grants & Finance | Use GrantConnect, ARENA, and state portals for open calls. Prioritise pilot or demonstration projects aligned with national net-zero pathways. |

Utilise Tax Credits & Carbon Markets | Apply for the R&D Tax Incentive and explore generating ACCUs through approved methods (e.g. landfill gas or bioenergy). |

Form Industry Partnerships | Secure offtake or pilot agreements with major emitters (e.g. airlines, mining, logistics). These strengthen funding proposals and de-risk projects. |

Implement Traceability Early | Integrate lifecycle data systems to prove fuel provenance and emissions. This will simplify future compliance under GO or export frameworks. |

Conclusion

Federal and state governments are channelling billions into the development of low-carbon fuels. While many programs are still evolving, the policy direction is pointing that companies should build domestic production capacity, ensure verifiable emissions data, and prepare for eventual domestic blending mandates.

Organisations that align early with grant criteria, financing programs, and traceability requirements will be well positioned to access funding and capture the next wave of Australia’s clean-fuel growth.

Main Sources

Australian Government, Department of Climate Change, Energy, the Environment and Water – Hydrogen Headstart Program

Australian Renewable Energy Agency (ARENA) – Hydrogen Headstart Round 2

Clean Energy Finance Corporation – Advancing Hydrogen Fund

Department of Climate Change, Energy, the Environment and Water – Powering the Regions Fund

Minister for Agriculture, Fisheries and Forestry – Low Carbon Liquid Fuels Announcement 2025

Department of Infrastructure, Transport, Regional Development, Communications and the Arts – Low Carbon Liquid Fuels Consultation

Queensland Government – Biofutures Queensland Programs

NSW Government – Net Zero Manufacturing Initiative

Victorian Government – Gas Substitution Roadmap

WA Government – Clean Energy Future Fund