7 mins read

Published Oct 27, 2025

Global SAF Blending Mandates & Emerging Policies: Your Go-To Guide

National Rules Driving Sustainable Aviation Fuel Adoption

Sustainable aviation fuel (SAF) is moving from pilot projects to regulatory reality. Governments are introducing national blending mandates that require a growing percentage of SAF to be mixed with conventional jet fuel. These policies create guaranteed demand, incentivise production, and set the framework for aviation’s net-zero targets.

The first mandates appeared in Europe, but Asia and the Americas are now following with their own frameworks. Even countries without binding targets are setting clear policy signals through incentives or credit systems.

For SAF producers, suppliers, and airlines, this means navigating a patchwork of rules, timelines, and reporting systems. The table below highlights some of the most important national-level SAF blending mandates and emerging frameworks around the world.

Global SAF Mandates at a Glance

Country/Region | Mandate Start | Blend Targets (Year → % SAF) | Synthetic SAF Sub-target | Enforcement/Penalties |

European Union (EU) | 2025 | 2% in 2025; 6% in 2030; 34% in 2040; 70% by 2050. | Yes. E-fuels: 1.2% of fuel by 2030 (within 6%); increasing to 35% of fuel by 2050. | Non-compliance fines; shortfalls must be compensated next year; no buy-out. |

United Kingdom (UK) | 2025 | 2% in 2025; 10% by 2030. | Yes. 0.5% of fuel must be PtL e-SAF by 2030; caps on conventional bio-SAF (HEFA) to encourage new tech. | “Buy-out” penalty: fuel suppliers can pay a per-liter fee for SAF shortfalls (tradeable SAF certificates system). |

2026 | 1% in 2026; 3–5% by 2030 (pending global supply) | Nonspecific – any certified SAF counts (no separate e-fuel sub-target). | SAF levy: airlines/fuel suppliers will pay a levy into a SAF fund if targets are not met (funds used to procure SAF credits). | |

2030 | Targeting 10% by 2030 (framework being finalised) | Not announced | Details under development; expected to apply to all departures; enforcement design in progress |

Europe: The Policy Benchmark

Europe remains the reference point for SAF regulation, setting the standard for binding quotas and synthetic fuel sub-mandates.

European Union – ReFuelEU Aviation Becomes Law

The EU’s ReFuelEU Aviation regulation is the most comprehensive SAF blending mandate globally.

Starts at 2% in 2025, reaching 6% in 2030, 34% in 2040, and 70% by 2050.

Includes a synthetic SAF sub-mandate: 1.2% e-fuels by 2030, rising to 35% by 2050.

Obligations are placed on fuel suppliers at each airport.

Penalties apply for shortfalls, which must be compensated in the next reporting year. There is no buy-out option.

Airlines must also uplift 90% of fuel at EU airports under scope, preventing tankering.

This locks in long-term demand and catalyses investment in e-fuel capacity.

United Kingdom – Ambitious Targets with Market Flexibility

The UK’s mandate mirrors the EU’s start date but sets higher 2030 targets with more flexibility.

2% SAF in 2025, rising to 10% by 2030.

0.5% of the total jet fuel pool must be Power-to-Liquid SAF by 2030.

HEFA contribution is capped over time to push advanced pathways.

Enforcement uses a certificate trading and buy-out system: suppliers can pay a per-litre fee for shortfalls.

The government is exploring revenue-support mechanisms to bridge the SAF price gap.

Ambitious targets plus flexibility are designed to build domestic SAF supply while keeping compliance viable.

Asia-Pacific: Regulation Meets Acceleration

Asia-Pacific is rapidly moving from feasibility to regulation, with Singapore and Japan taking the lead and others testing policy pathways.

Singapore – Asia’s First National SAF Mandate (2026)

Singapore is becoming a regional leader in SAF adoption. The country hosts major SAF production facilities (such as Neste’s refinery) and is implementing the first mandatory SAF blend in Asia, starting in 2026.

1% SAF blending requirements for all flights refuelling in Singapore, increasing to 3–5% by 2030 depending on global supply.

Any certified SAF pathway counts (no separate synthetic sub-quota).

SAF levy on uplifted fuel funds central procurement of SAF and/or SAF certificates.

The levy effectively functions as a built-in backstop if physical uptake lags.

A pragmatic model to stimulate demand without overburdening airlines early.

Japan – National Framework Targeting 10% SAF by 2030

Japan is finalising a national framework targeting 10% SAF by 2030 for all flights departing the country.

Policy design indicates qualifying SAF must achieve ~50% lifecycle GHG reduction.

No dedicated synthetic sub-quota announced.

Enforcement and reporting details under development; scope expected to cover domestic and international departures.

One of Asia’s most ambitious targets; authorities are preparing supply via domestic projects and imports.

Emerging Asia-Pacific Policies – Early Market Signals

Country | Mandate / Target | Timeline | Policy Status | Notes |

No binding SAF blend mandate.

| – | Exploratory / incentive phase | Government signals supportive policy direction in aviation decarbonisation papers and funding programs, but no legislated blend % or enforcement. Focus is on feasibility studies, domestic feedstocks, early offtakes, and project financing. | |

50,000 t SAF target | 2025 → potential 5% by 2030 | Target / expected mandate | SAF included in national Five-Year Plan; formal 2030 blending rule anticipated but not yet published. | |

1% SAF blend for international flights | 2027 → gradual scale-up | Proposed / policy drafting underway | The Ministry of Land, Infrastructure and Transport (MOLIT) announced plans in 2024 to introduce a 1% SAF blending requirement by 2027, aligned with ICAO’s CORSIA objectives. The rule is not yet finalised; enforcement mechanisms and penalties are under development. | |

Targeting 1% SAF on international flights by 2027, rising to 5% by 2030 | 2027 → 2030 | Declared goal / under formulation | Government using target to attract SAF investment, especially from ethanol feedstocks. | |

1% by 2027 → 2.5% by 2030 SAF blend | 2027 → 2030 | Proposed / roadmap adopted | National SAF roadmap sets phased blending goals; implementation details pending. | |

1% by 2027 → 47% by 2025 SAF blend | 2027 → 2050 | Consultation stage | SAF mandate framework under stakeholder consultation; scaling tied to domestic biofuel roadmap. More on Malaysia's climate commitments. | |

1% by 2026, 1–2% by 2030, 8% by 2036. | 2026 → 2036 | Non-binding targets | Early targets supported by investment incentives for SAF projects. | |

— | — | Roadmap under development | SAF policy framework and feedstock studies underway. | |

— | — | Exploratory stage | No SAF mandate yet; early policy discussions ongoing. |

The Americas: Mandates, Incentives, and Emissions Targets

Across the Americas, SAF policy ranges from credit-based incentives to emissions-reduction mandates, combining federal and regional systems.

Canada – Hybrid System with Provincial Enforcement

Canada has no federal SAF mandate yet but has aspirational use goal of 10% SAF by 2030.

SAF use generates credits under the Clean Fuel Regulations, creating an incentive without a legal obligation.

British Columbia has the continent’s first provincial SAF rule:

1% SAF by 2028

3% SAF by 2030

Enforced under the provincial LCFS with credit and penalty mechanisms.

This hybrid approach combines federal incentives with provincial mandates.

Brazil – Emissions-Based SAF Rules (Book-and-Claim Eligible)

Law enacted 2024 sets aviation GHG reductions of 1% (2027) → 3% (2030) → 10% (2037).

Allows Book-and-Claim compliance credits.

Implementation rules rolling out through 2025.

Chile – SAF Roadmap Built on Green Hydrogen Potential

National roadmap targets 50% SAF by 2050.

Policy focus on PtL production from domestic renewable hydrogen.

United States – Incentive-Led Growth Without a Federal Mandate

SAF tax credit $1.25–$1.75/gal under the Inflation Reduction Act, tied to GHG reduction.

State Low Carbon Fuel Standards (e.g., California) reward SAF use.

Federal goal of 10% SAF by 2030 remains voluntary.

Middle East: Voluntary Targets and Early Pilots

Middle Eastern economies are exploring early pilots and voluntary SAF initiatives, while emerging markets are shaping regional supply capacity.

Country | Mandate / Target | Timeline | Policy Status | Notes |

Voluntary 1% SAF target | 2031 (production target 2030) | Announced / voluntary framework | Government aims to produce 700 million litres of SAF annually by 2030, supported by projects such as ADNOC–Masdar–Etihad SAF initiatives and PtL pilot plants. More on UAE's climate commitments. | |

1% SAF blend by 2025, 5% by 2030 (international flights) | 2025 → 2030 | Proposed / under policy design | Target included in Turkey’s national decarbonisation roadmap and aviation GHG reduction plan; formal regulatory text pending. | |

No SAF mandate or target | — | Exploratory stage | SAF feasibility studies underway through NEOM Green Fuels and Aramco–TotalEnergies initiatives; policy options under review. | |

No SAF mandate or target | — | Exploratory stage | Engaged in SAF R&D collaborations and renewable hydrogen programs; no blending targets announced as of 2025. |

Operational Implications Across the SAF Supply Chain

Farms and waste aggregators must prioritise aligning with sustainability criteria and maintain appropriate documentation pertaining to the feedstocks.

Processing facilities must focus on feedstock sourcing, voluntary certification, and process emissions accounting at once.

Traders, distributors and storage facilities need systems that trace batches with chain of custody, manage documentation, and verify sustainability claims across markets.

Synthetic sub-targets in regions like the EU and UK are accelerating investment in e-fuel capacity, while Asia’s flexible policies are opening early trading and feedstock offtake opportunities.

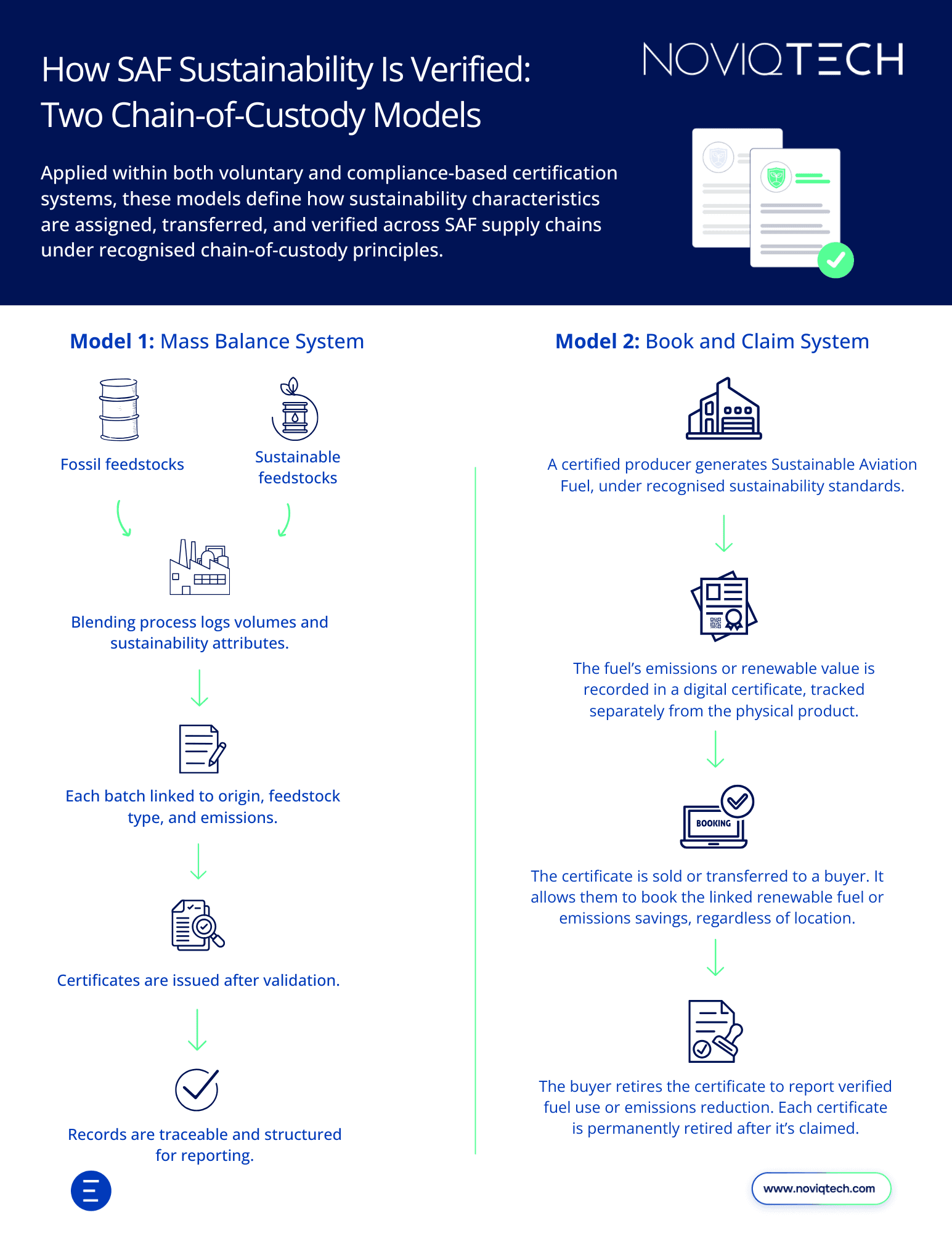

Figure 1: How SAF Sustainability is Verified: Mass Balance and Book and Claim Models

Build a Compliant SAF Strategy

Fuel Central helps feedstock producers, processing facilities and distributors integrate SAF requirements into their end-to-end value chains.

We support:

End-to-end chain of custody tracking across supply chains and operators.

Digital book-and-claim functionality for attribute-based offtakes.

Automated compliance reporting across regions.

With emerging regulations and rising global demand for sustainability in the aviation sector, SAF mandates are turning traceability into a mandatory requirement. Fuel Central gives you the digital infrastructure to manage compliance and open new markets.

Book a call to see how to integrate traceability across your SAF operations.

Source & Legal Footnote Appendix

Primary Source / Government / Legislative Document | Notes & URLs |

Regulation (EU) 2023/2405 “ReFuelEU Aviation” | EU Official Journal. (EUR-Lex) |

ReFuelEU regulation & Commission materials | ReFuelEU Handbook. (IATA) |

ReFuelEU Regulation Article 4, Article 5; EU FAQ | The regulation prohibits paying a fee instead of compliance. (European Transport) |

ReFuelEU Regulation; EU FAQ | Prevents airlines avoiding SAF via tankering. (European Transport) |

UK Compliance Guidance, “The SAF Mandate: an essential guide” | Government guidance document. (GOV.UK) |

Legislative Order / SAF Mandate rules & policy documents | Set in the draft legislation under the UK SAF mandate. (Legislation.gov.uk) |

Government announcements / policy briefings | RCM draft-legislation proposed in May 2025. (Clifford Chance) |

CAAS documents; press releases | Confirmed in the Sustainable Air Hub Blueprint and local press. (S&P Global) |