6 mins read

Published Jan 12, 2026

ReFuelEU Aviation Explained: SAF Mandates, Airline Refuelling Rules, and Compliance Requirements

The ReFuelEU Aviation Regulation [Regulation (EU) 2023/2405] is a legislative framework promoting the uptake of sustainable aviation fuels (SAF) across the EU. It sets mandatory SAF blending targets for fuel suppliers, creating a ‘level playing field’ for airlines and supporting the EU’s goal of cutting net greenhouse gas emissions by at least 55% by 2030 (Fit for 55 Package).

Meeting these targets ensures that the European aviation sector contributes to climate objectives while maintaining connectivity and competitiveness. The regulation encourages early market action and strategic investment in feedstocks and fuel supply, and enforces compliance through penalties, aligning all stakeholders with the transition to a sustainable aviation sector.

ReFuelEU in Brief

The regulation is a part of the EU’s Fit for 55 package of European climate laws .

It applies to all flights departing from major EU airports considered as the Union airports, aviation fuel suppliers and aircraft operators serving these airports.

It sets legally binding SAF blending targets,with sub-targets for synthetic fuels and a 90% refuelling obligation for aircraft operators.

It includes penalties, carry-over rules, compliance monitoring and traceability through the EU Union Database (UDB).

It requires SAF to be made from feedstocks listed under Annex IX to the Renewable Energy Directive (EU) 2018/2001).

Key Targets and Timelines

Year | SAF Blend (Min.) | Synthetic Fuels Sub-Mandate | Airline Refuelling Rule (tankering obligations) |

2025 | 2% | – | 90% uplift rule begins |

2030 | 6% total (1.2% synthetic) | 90% uplift continues | |

2035 | 20% (5% synthetic) | 5% | 90% uplift remains in force |

2040 | 34% (10% synthetic) | 10% | 90% uplift remains in force |

2045 | 42% (15% synthetic) | 15% | 90% uplift remains in force |

2050 | 70% (35% synthetic) | 35% | 90% uplift remains in force |

What Qualifies as Eligible Feedstocks for SAF

Alongside with meeting strict sustainability criteria and GHG emissions reduction requirements, SAF produced from the following feedstocks are qualified as eligible ‘minimum SAF shares’ set out in Annex I of the ReFuelEU Aviation Regulation:

Advanced biofuels as per Part A of Annex IX to Directive (EU) 2018/2001.

Biofuels produced from feedstocks listed in Part B of Annex IX to Directive (EU) 2018/2001, representing the most commercially mature SAF technologies.

Synthetic and low-carbon aviation fuels: Includes RFNBOs/e-SAF produced from renewable hydrogen and captured CO₂, recycled-carbon aviation fuels (RCAF), and other low-carbon fuels that meet the required lifecycle GHG savings thresholds.

Renewable share of co-processed bio-intermediates, provided the renewable portion comes from feedstocks listed in Annex IX of Directive (EU) 2018/2001 (excluding food/feed crops and other restricted feedstocks).

Other aviation biofuels meeting RED II/III sustainability and GHG criteria, with a maximum 3% allowance for biofuels outside Part A or Part B Annex IX feedstocks, supplied across EU airports.

Note: Eligibility is dynamic and may evolve as new sustainable feedstocks are added to Annex IX of Directive (EU) 2018/2001. For example, a few feedstocks were added to the Annex IX in 2024 through the Delegated Directive (EU) 2024/1405.

SAF produced from the following feedstocks shall be excluded from the calculation of the ‘minimum SAF shares’ set out in Annex I of the ReFuelEU Aviation Regulation:

Food and feed crops (as defined in Article 2(2)(40) of Directive (EU) 2018/2001)

Intermediate crops

Palm fatty acid distillate (PFAD) and palm- or soy-derived materials

Soap stock and its derivatives

Reporting Requirements

Reporting by Fuel Suppliers

Under ReFuelEU Aviation, fuel suppliers must report annually to the Union database (UDB) by 14 February, 2025 to ensure transparency and traceability of aviation fuels and SAF. The database tracks certified fuels from feedstock origin to market, helping prevent fraud and ensuring data quality.

Suppliers must report:

Total aviation fuel and SAF volumes per EU airport.

SAF type, feedstock origin, conversion process, and lifecycle emissions.

Aromatics, naphthalenes, sulphur content, and energy content by batch.

Reporting by Aircraft Operators

Aircraft operators must submit verified annual reports by 31 March (from 2025) to their competent authority and EASA. Reports ensure accurate monitoring of fuel use and SAF uptake.

Operators must report:

Total fuel uplifted and required per airport.

Tanked and non-tanked quantities.

Total SAF purchased with supplier details, feedstock origin, and lifecycle emissions.

Total flights covered (number and hours).

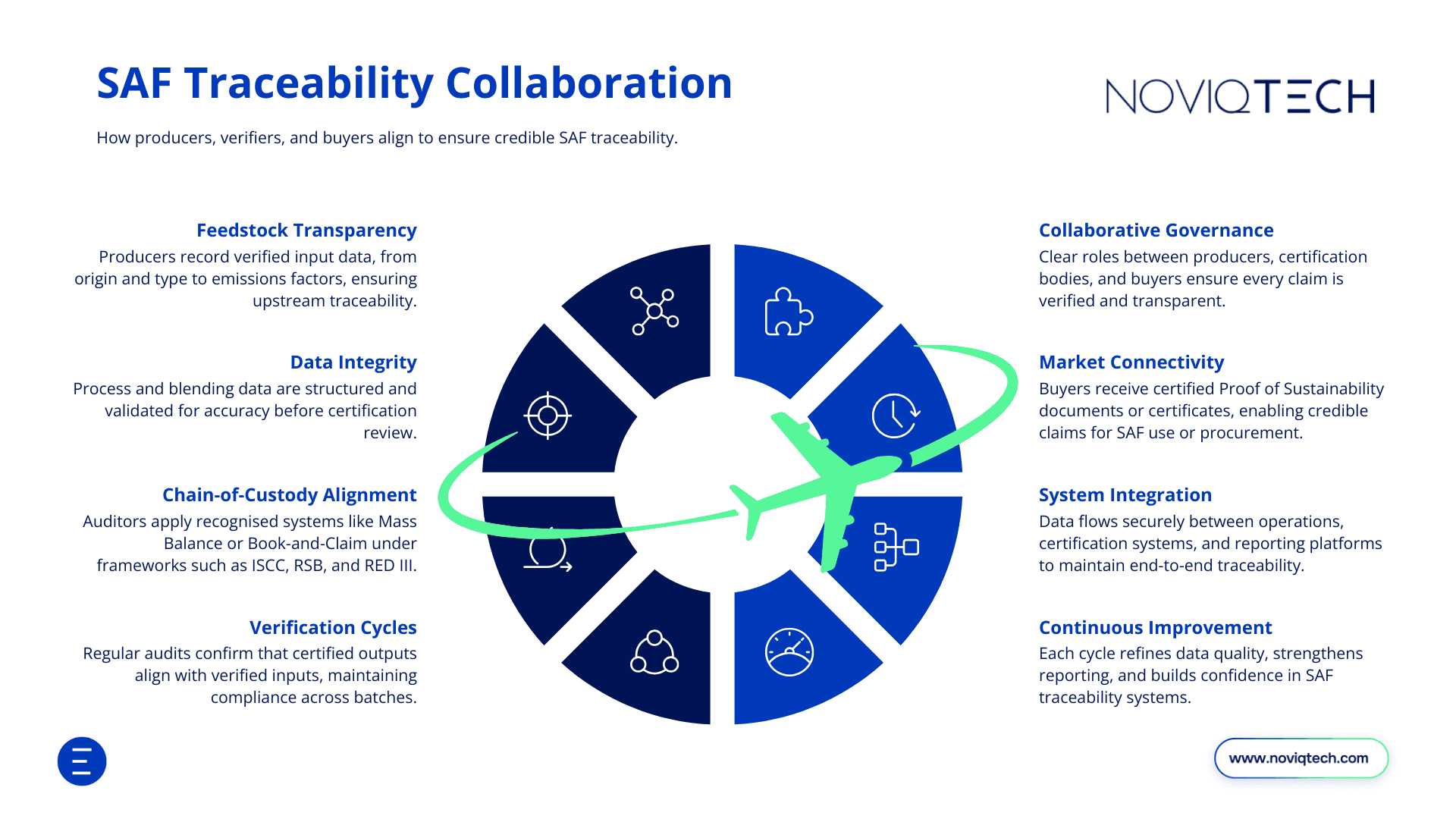

Figure 1: Sustainable Aviation Fuel Traceability Collaboration.

SAF Claims under GHG Schemes

Aircraft operators may claim SAF use under schemes such as EU ETS and CORSIA, but must avoid double counting. Reports must include:

Declarations of GHG schemes used and confirmation that SAF batches are not reported under multiple schemes.

Participation in financial support schemes and confirmation that batches are not claimed under more than one scheme.

Scheme-specific guidance

EU ETS: SAF is zero-rated for emissions, with the fossil fraction counted. Mass balance must be used, especially when SAF cannot be physically segregated. Up to 20 million ETS allowances (2024–2030) are reserved to offset part of SAF costs.

CORSIA: Operators claim emissions reductions from CORSIA-eligible fuels based on purchase and blending records. SAF must meet CORSIA sustainability criteria, which may differ from EU RED, though some batches can be certified under both systems. Aircraft operators may claim a SAF batch under only one greenhouse gas scheme and must declare to EASA that no batch is reported under multiple schemes, though they may choose which eligible scheme to use if a batch meets multiple certifications.

Penalties

Member States must set clear and strong penalties to make sure ReFuelEU Aviation rules are followed, with fines designed to match the seriousness of any breach. Revenue from fines is encouraged to support SAF research, production, and cost-reduction initiatives.

Aircraft operators: Fines apply if minimum fuel uplift requirements are not met, calculated at least twice the value of the missing fuel based on average aviation fuel prices.

Fuel suppliers: Fines apply if they fail to supply required SAF or synthetic fuels, or if they give false or misleading information about SAF. Penalties are at least twice the value of the shortfall or misreported quantity. Paying fines does not excuse them from meeting obligations in the future.

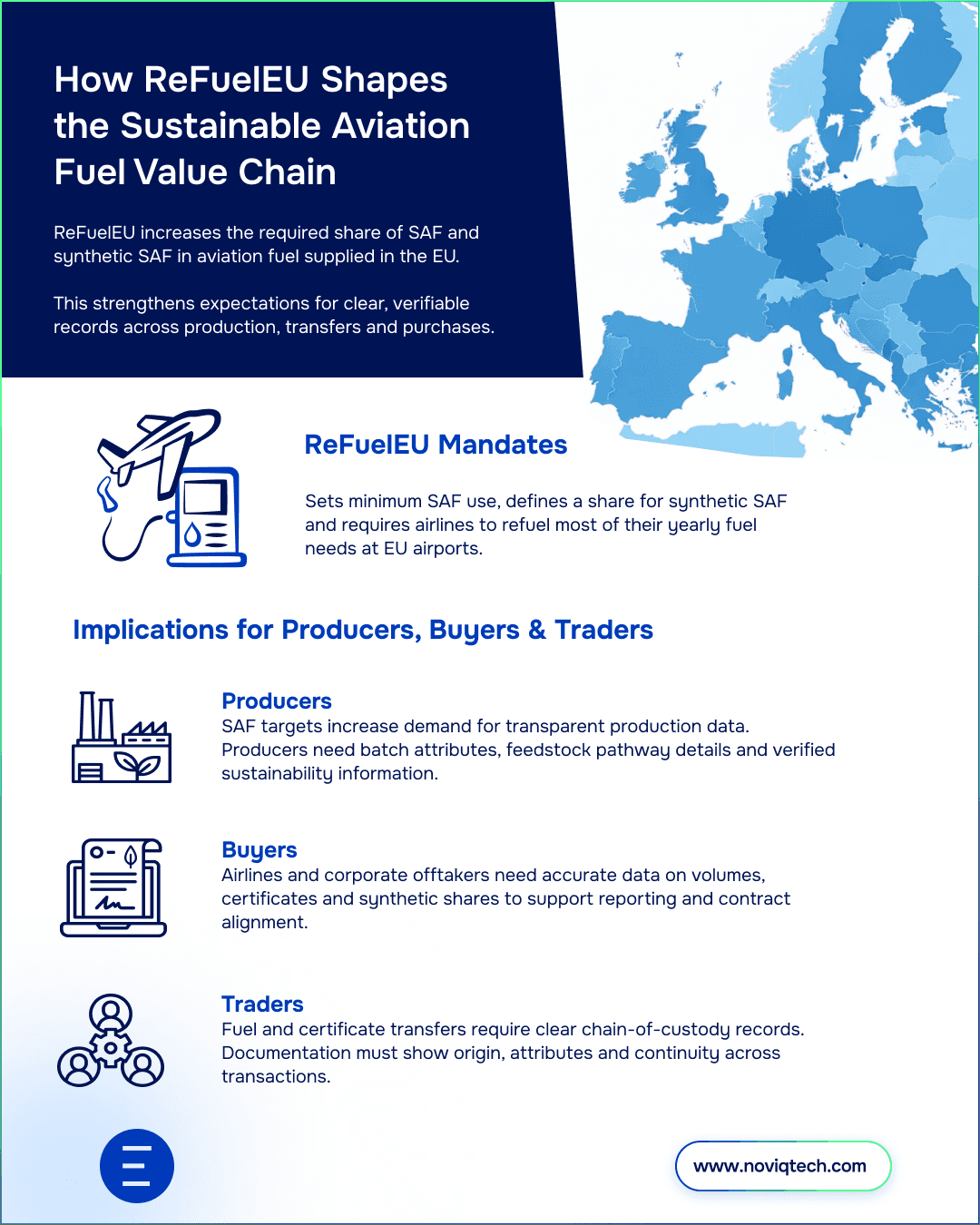

Figure 2: How ReFuelEU Regulation Shapes the Sustainable Aviation Fuel Value Chain

Conclusion

ReFuelEU Aviation establishes a clear framework to increase the use of sustainable aviation fuels across the EU, with defined obligations for fuel suppliers and aircraft operators, robust reporting requirements, and enforceable penalties.

By ensuring traceability, credible claims, and compliance with greenhouse gas schemes like EU ETS and CORSIA, the regulation supports transparency, prevents double counting, and drives measurable emissions reductions.

For stakeholders across the aviation value chain, understanding and adhering to these rules is essential to unlocking the environmental and economic benefits of SAF, while contributing to Europe’s broader goals of a low-carbon, circular economy in aviation.

Fuel Central enables end-to-end traceability across SAF supply chains through our mass balance chain of custody and SAF credit management platform, helping operators meet ReFuelEU Aviation requirements with confidence.

Book a call to explore how to integrate traceability and compliance into your SAF operations.